China's economic recovery is built on increasingly shaky foundations and that could affect the whole world

China is trying to revive its economy to reach pre-COVID heights but future growth rates might be closer to developed economies like the US and UK.

Confidence in China’s post-COVID recovery has started to waver over the past week after the world’s second-largest economy reported disappointing figures for two of the major drivers of its economy: property and exports.

In response, China’s central bank is taking the opposite approach to western counterparts like the Bank of England by cutting its main interest rates to try to stimulate investment in its economy.

The Chinese government had hoped to recapture previous economic highs after ending its zero-COVID policy in December 2023. But there are some indications that the country may instead settle into the same moderate growth patterns over the medium to long term as other advanced economies.

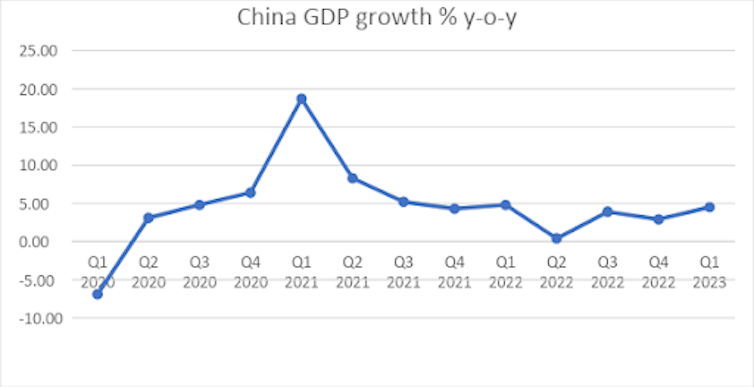

When Chinese GDP growth bounced back to exceed market expectations in the first quarter of 2023, growing at 4.5% year on year, it was good news for China and for the global economy. The surge was partly led by retail sales shooting up by 10.6% in March as the lifting of COVID restrictions in December 2022 started to filter through to the domestic economy.

More importantly for the global economy, the end of China’s COVID restrictions unblocked supply chains and led to a hefty 14.8% rise in exports in March compared with the same month in 2022. Of course, it’s easy to hit high growth rates from a low base, but this was still a welcome sign that China could meet International Monetary Fund (IMF) expectations for GDP growth of 5.2% in 2023.

However, all was not what it seemed: China’s recovery is actually built on quite shaky foundations. There is weakness in domestic real estate investment and export expectations due to uncertain global demand and ongoing trade frictions with the US. So what can – and should – the Chinese government do about this?

Domestically, the Chinese government has started to use monetary policy – interest rate cuts – to generate growth via personal and business borrowing. And the amount of money circulating in China’s economy has picked up because people and businesses are finding it easier to borrow. This means that domestic demand could help meet the government’s official 5% growth target for 2023.

Longer-term, however, uncertainty abounds about China’s growth prospects. The IMF has forecast GDP growth of 4.5% in 2024, falling to around 3.2% by 2028. This slowdown is expected because of issues including further fragility in China’s real estate sector and a decline in its workforce due to age.

Read more: China property crisis: why the housing market is collapsing – and the risks to the wider economy

Before COVID, China put its increasingly urban, working-age population to work in booming industries such as green tech to turbocharge its growth. This partly drove soaring GDP growth from -27.3% in 1961 to 6% pre-COVID. But achieving similar rates of growth won’t be as easy in the future.

The reasons for the spectacular past performance of China’s economy are well known: the 1978-2019 period was when China opened up its economy and saw its exports boom. Research often links competition through trade to productivity and growth. It also helped that, during this time, China shifted its manufacturing focus from low-productivity industries such as mining heavy metals and coal to highly productive enterprises like computing and green technology.

As mentioned, urbanisation and the shift in population from rural to urban areas have played a part in China’s past positive performance. And China’s government has also used infrastructure investment to boost business performance during downturns quite effectively.

Long-term, moderate growth

China is unlikely to be able to use the same strategies to return to its previous high-growth path. It’s much more likely to settle into the kind of moderate growth experienced by developed economies like the US and UK (pre-COVID).

To understand why, let’s start with the fundamentals. The size of its workforce is declining, affecting the contribution of labour to the economy. China is also facing a demographic problem of a decreasing population – a drop of 850,000 last year – and an increasing dependency ratio. This means there are fewer workers to support those that have retired.

An increasing dependency ratio has implications for the future of trade because total population consumption will start to outstrip whatever is produced by the working population. Domestic demand will grow faster than domestic output and this will create a mismatch when it comes to the way China has traditionally invested in its economy.

In the decades since it opened up its economy, China invested in domestic businesses (state-owned enterprises) through its largely state-owned banks. But if China’s savings ratio starts to fall due to its demographic changes – as its ageing population stops working and starts spending their savings rather than generating more income – the Chinese government will have to find a new way to finance its domestic investment in the private sector.

The state’s reputation for strong intervention in private industry will complicate this issue by weakening growth in private investment, which will further restrict the domestic economy. Stronger regulation of shadow banking has decreased access to finance for both people and businesses. The financial sector remains heavily regulated and high-profile interventions in the digital economy have created a sense of uncertainty that may weaken private investment.

A recent World Bank Group study projects Chinese growth of 4% in the decade after 2030, if there are comprehensive reforms in areas like state regulation of private business. But with only limited reform, 2030’s growth is projected to fall below 2%, according to the World Bank. This will have an impact far beyond China’s borders.

The country has the potential to grow faster than the advanced economies for decades if it can overcome these challenges. And, of course, whatever happens in China is likely to have a major effect on global growth.

Kent Matthews receives funding from the ESRC (ES/P004199/1) for the project Shadow Banking and the Chinese Economy: A Micro to Macro Modelling Framework